Goldman & Associates Law Firm – Your Reliable Michigan Family Law Legal Partner

At Goldman & Associates Law Firm, our experienced Michigan family law attorneys have been serving clients for over two decades. We’re committed to delivering the best legal solutions to our clients. We offer a complimentary initial consultation to assure you that we’ll tirelessly fight for your rights. Whether you’re dealing with legal issues related to criminal matters, personal injury, or family law, our law firm can provide the legal assistance you need. Our dedicated legal team is not only here to protect your present but also to secure your future.

If you need clarity on your rights and responsibilities, we invite you to reach out to Goldman & Associates Law Firm, a statewide Michigan family law firm located in the metro Detroit area. Schedule your free phone consultation with our expert family law attorney today. Don’t delay addressing your legal concerns any further. We can deliver the results you’re seeking to get your life back on track. Seek legal counsel from our experienced attorneys – call our 24/7 toll-free number at (877) 737-8800.

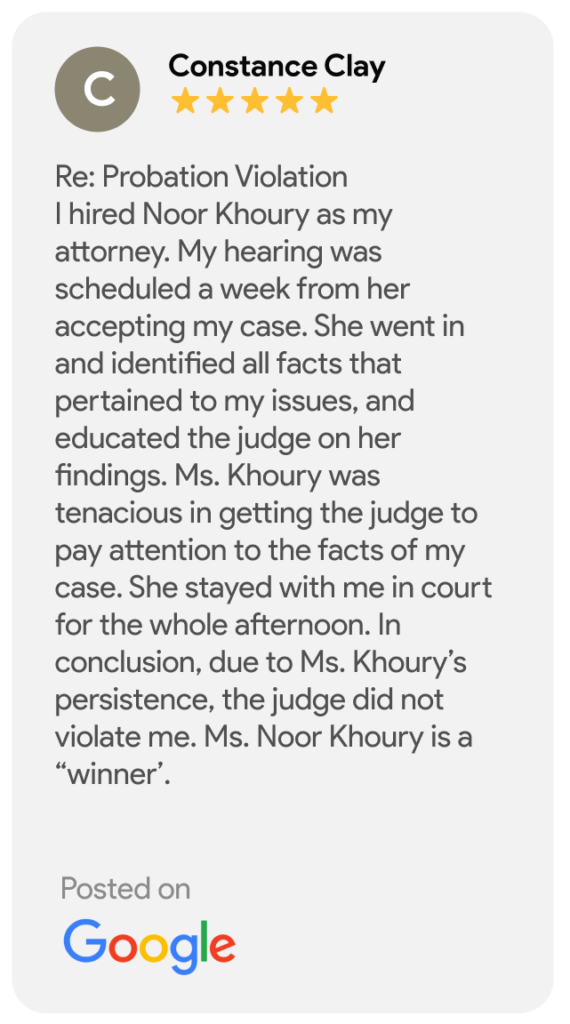

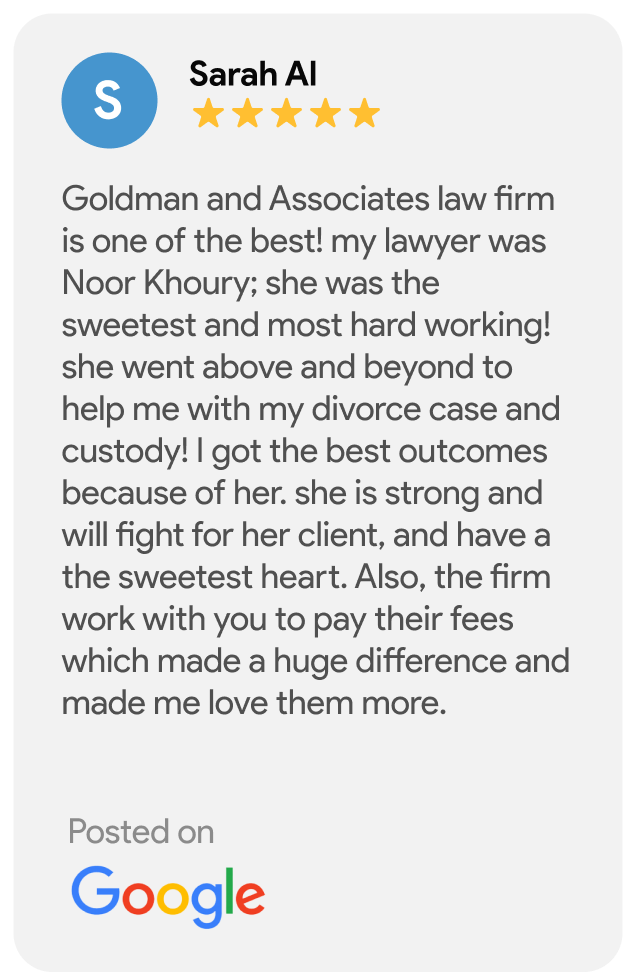

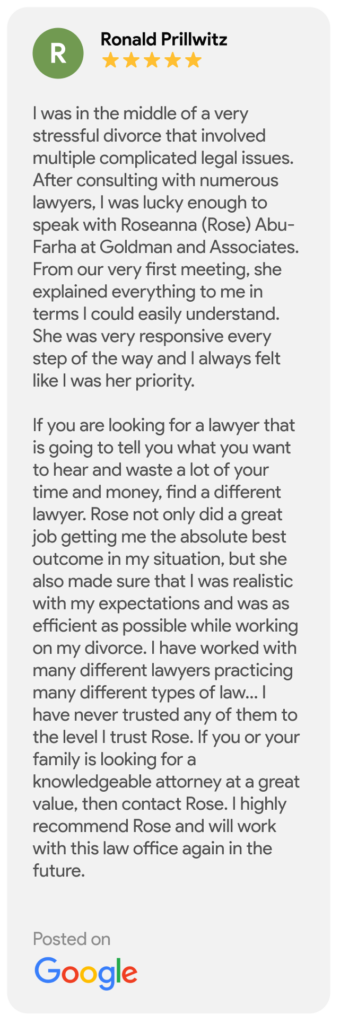

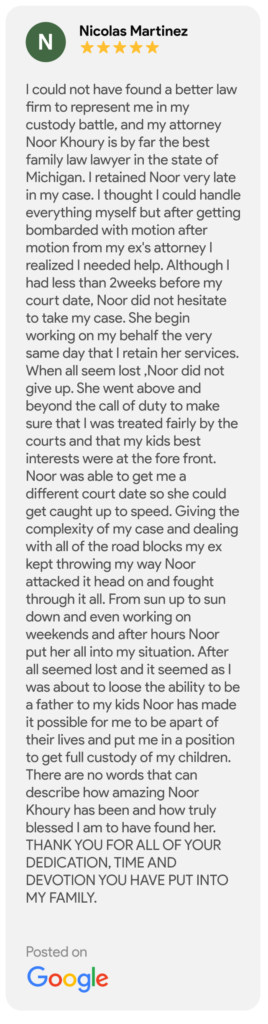

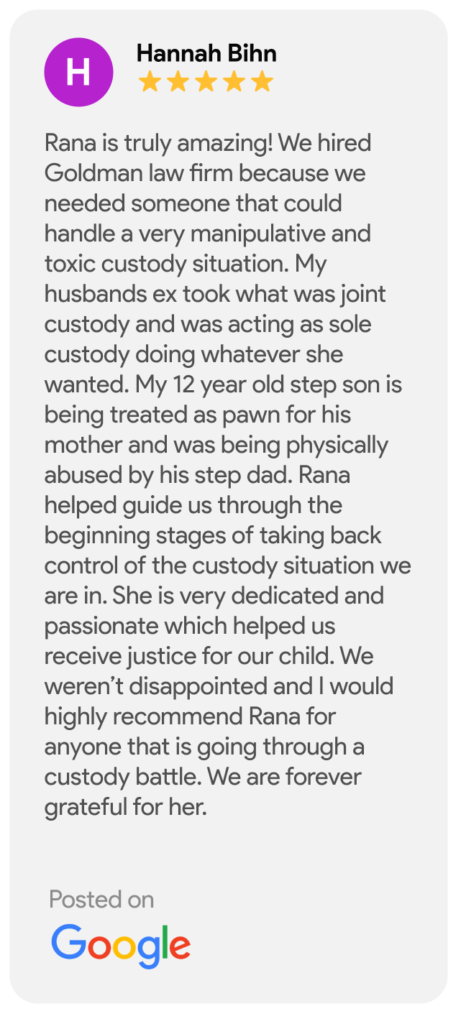

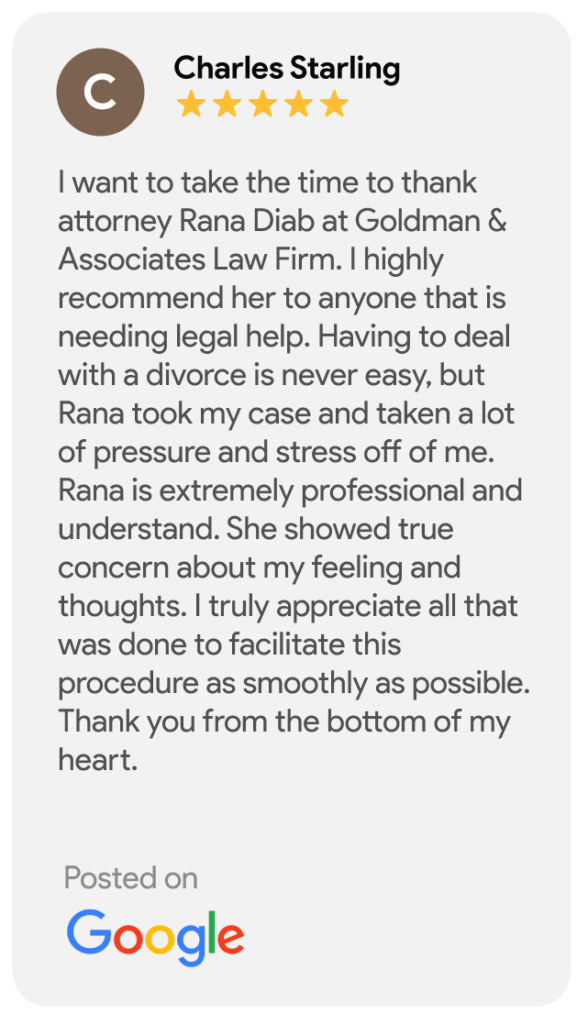

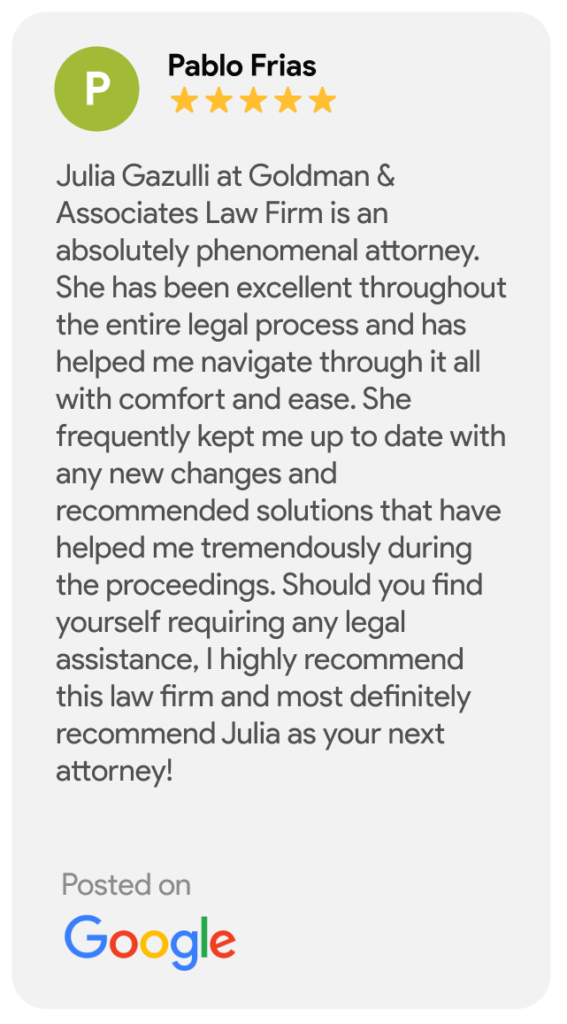

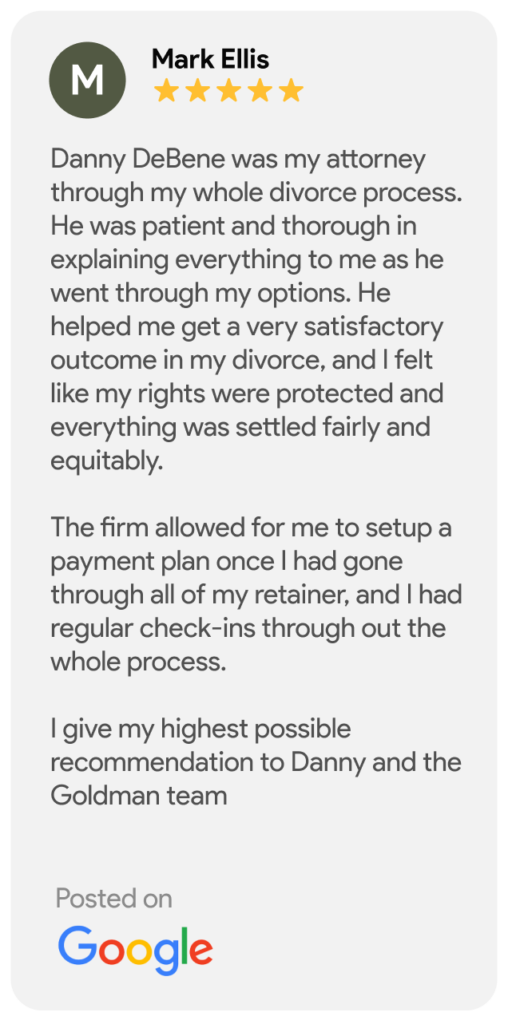

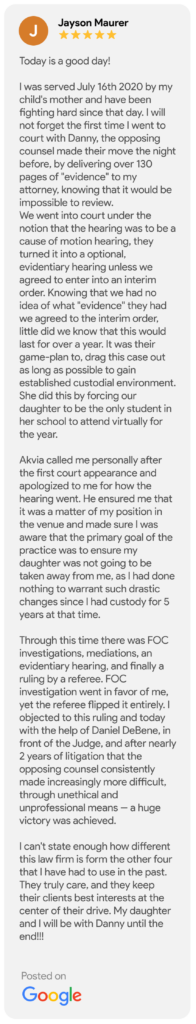

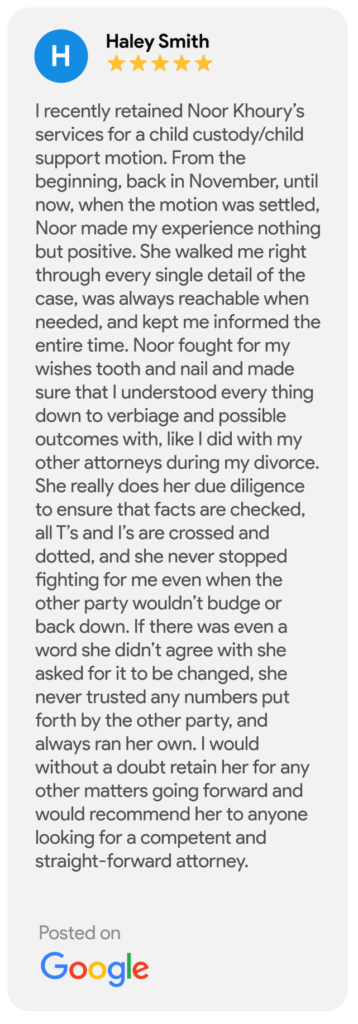

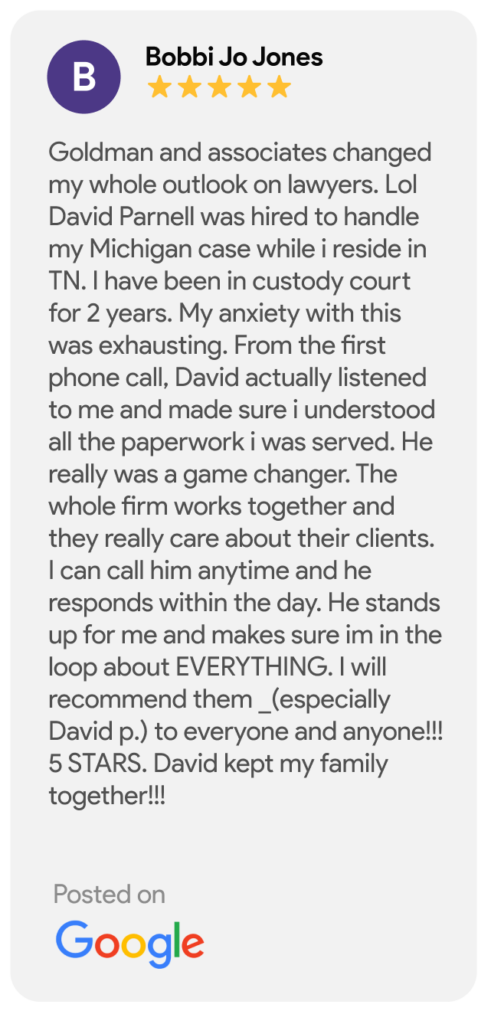

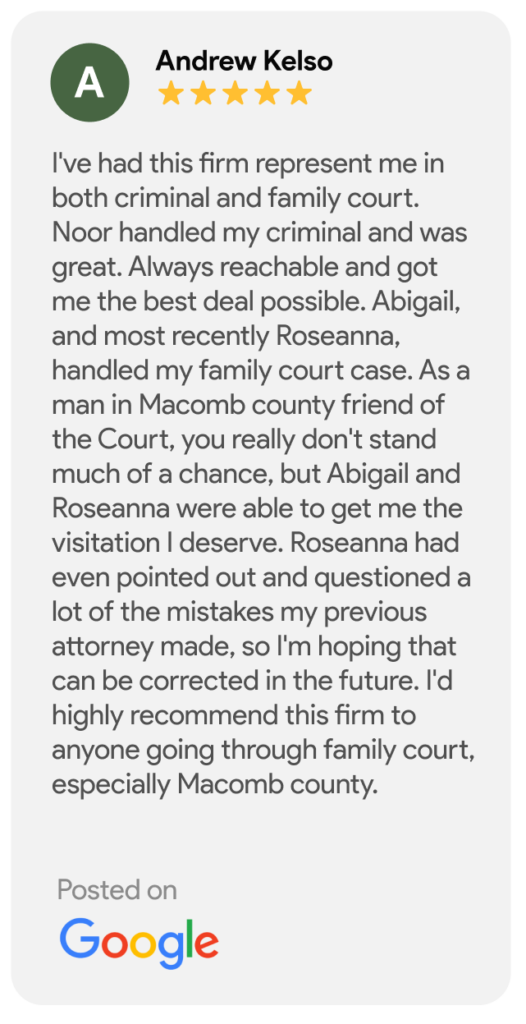

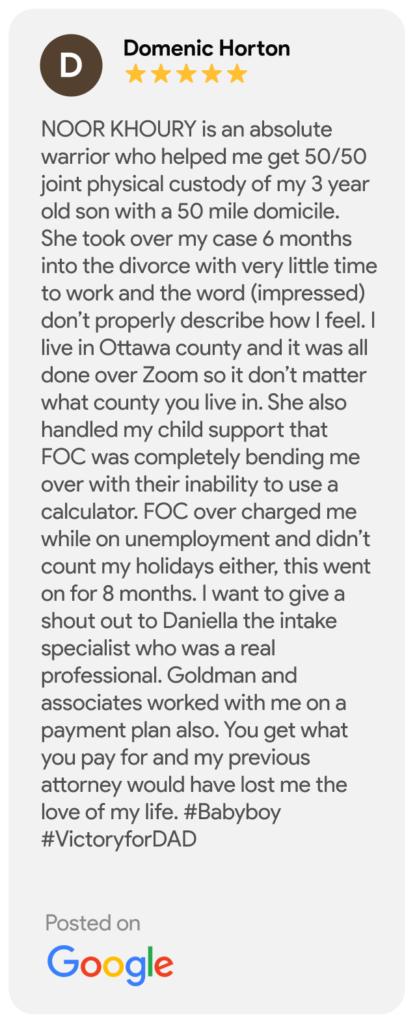

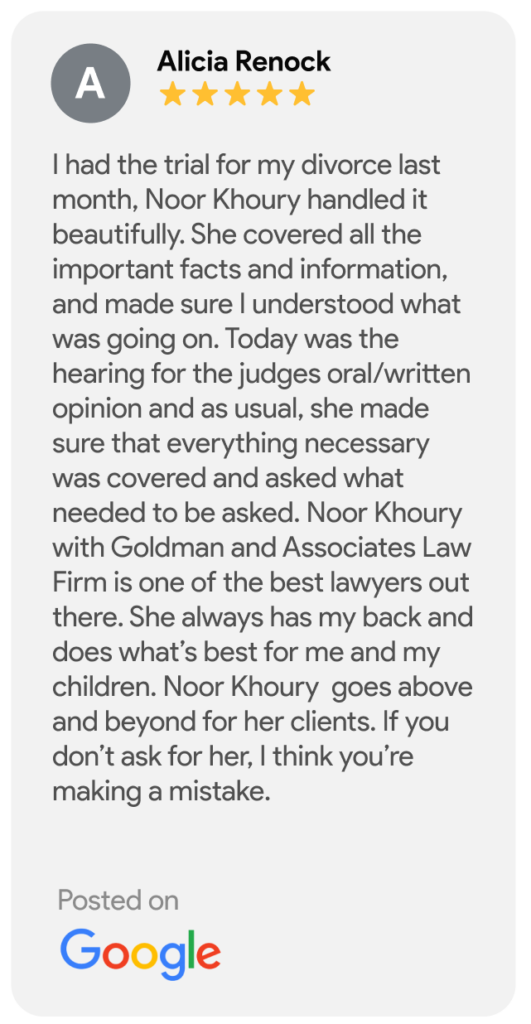

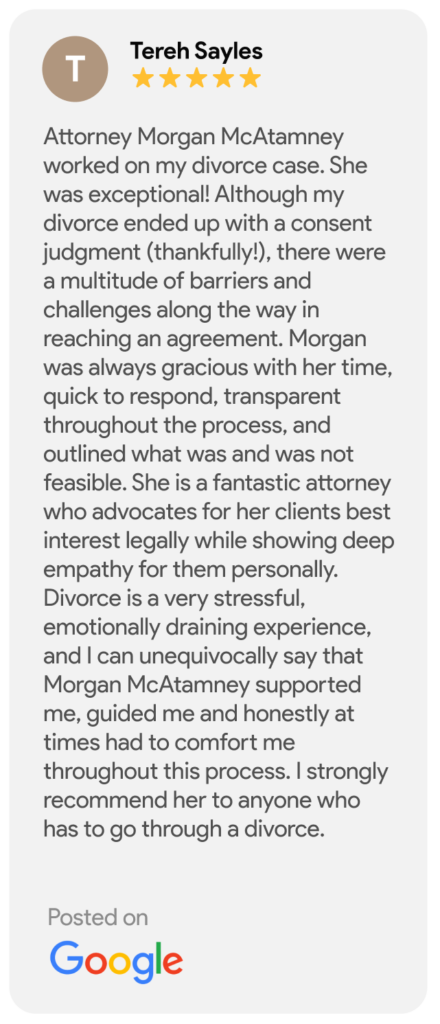

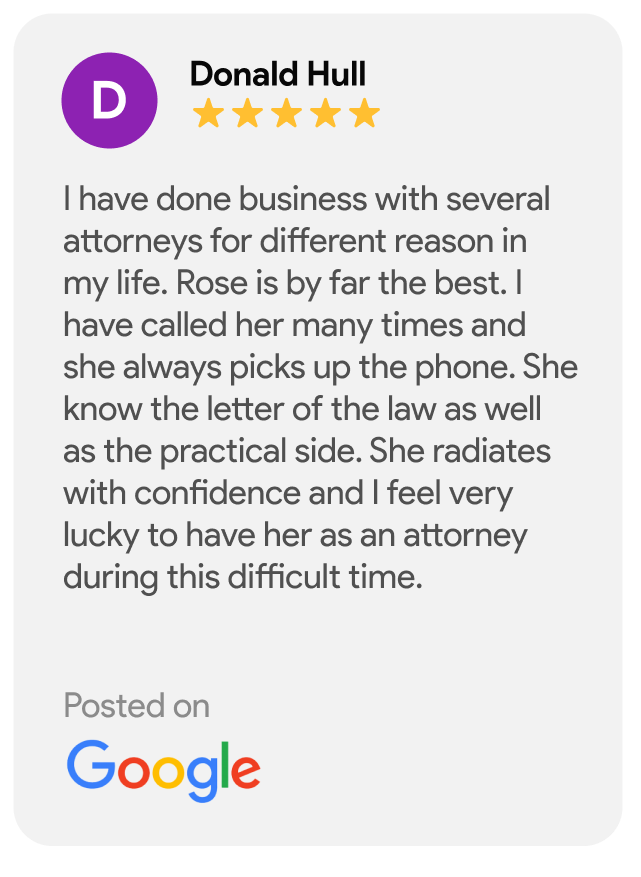

See What Our Previous Clients Say About Us!

Our Google Reviews

Contact Us Today For A Complimentary Phone Case Evaluation

Call us 24/7 at (248) 590 6600 Call/Text or Click here to schedule your complimentary consultation.

We Are Here To Help!

How We’re Different From Other Michigan Family Law Firms

When it comes to family law in Michigan, choosing the right legal representation is crucial. At Goldman & Associates Law Firm, we are your trusted Michigan Family Law Attorneys. We are a well-established Michigan Family Law Firm with a team of dedicated and compassionate attorneys in Michigan.

Peace of Mind: We remove the uncertainty and fear associated with any family law matter by providing professional, compassionate family law services.

Collaboration and Education: You don’t want an attorney to bark orders at you and not explain what’s going on. Count on us to guide and educate you through the uncertainty and confusion of the legal process. This helps to remove your fear and helps empower you.

Constant Communication: Effective communication between clients and attorneys is paramount to achieving optimal outcomes in all matters pertaining to family law. At Goldman & Associates, our team of highly experienced legal professionals ensures a flow of timely updates, keeping you informed every step of the way.

“Our goal is to remove the fear associated with divorce and custody issues – guide you and help you navigate this process, and protect you by helping to maximize your time with your kids and your money, as quickly as possible.” – Akiva Goldman

Shepherding You When the Law Meets a Broken Marriage

No one enters into a marriage thinking it will end in divorce, but unfortunately, divorce does happen. If you’re having marital problems and are faced with the reality of a broken marriage, you will need to make some very difficult decisions. One of those decisions may be whether or not to seek legal counsel for a divorce.

No one enters into a marriage thinking it will end in divorce, but unfortunately, divorce does happen. If you’re having marital problems and are faced with the reality of a broken marriage, you will need to make some very difficult decisions. One of those decisions may be whether or not to seek legal counsel for a divorce.

Seeking legal representation is not always necessary, but because divorce is a legal matter, there are some key legal aspects that you should be aware of.

There are specific laws that will govern how your divorce is handled in the state of Michigan. Experienced divorce attorneys will be familiar with those laws and rules, as well as the judges and commissioners who interpret those laws and rules, and can help you navigate the divorce process.

There are a few different ways to get divorced in Michigan. The most common way is to file a divorce petition with the court. In order to do this, one of the spouses must have been a resident of Michigan for at least three months. The divorce petition will state the grounds for divorce and ask the court to dissolve the marriage.

If both spouses agree on all of the terms of the divorce, they may be able to complete it without going to court. This is called an uncontested divorce. An attorney can provide legal assistance to file the necessary paperwork and make sure that everything is done correctly.

If there are disagreements about some of the terms of the divorce, the divorce will be considered contested. In a contested divorce, the spouses will have to go to court and argue their case in front of a commissioner or judge. This can be a long and expensive process, and it is almost always best to seek legal representation if things start to get contentious.

If there are disagreements about some of the terms of the divorce, the divorce will be considered contested. In a contested divorce, the spouses will have to go to court and argue their case in front of a commissioner or judge. This can be a long and expensive process, and it is almost always best to seek legal representation if things start to get contentious.

If your legal team knows what they are doing, the first thing they will do is help you understand the laws and legal issues that will govern your divorce. Your lawyer will also help you negotiate any disputes with your spouse and advise you on the best way to resolve your case so you obtain the goals you’re looking for. If litigation is necessary, an attorney will represent you in court and make sure that your interests are protected.

We’ve Created a Free Guide Called the Michigan Divorce & Child Custody Survival Guide

This free guide will help to educate you about divorce in Michigan, help you navigate legal matters, and help you make the best decisions for yourself and your family.

Divorce Attorney Michigan

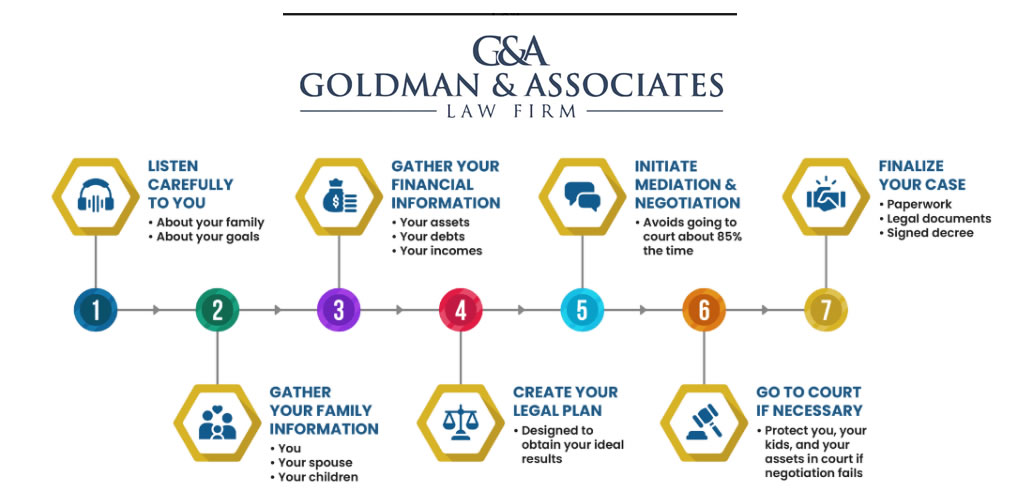

Our Proven-Process For Helping You

Through A Divorce in Michigan

Contact us Today For A Complimentary Phone Case Evaluation

Call us 24/7 at (248) 590 6600 Call/Text or Click here to schedule your complimentary consultation.

We Are Here To Help!

Types of Divorce We Can Help You With

Our family law firm is devoted completely to divorce and family law matters. Here are some of the kinds of divorce cases we provide legal assistance for.

When Seeking a Dependable Family Law Attorney in Michigan, Rest Assured that Our Dedicated Team is Here to Provide Unwavering Support Throughout Your Entire Case!

When it comes to family law matters in Michigan, you need a reliable partner by your side. Our experienced Michigan Family Law Attorneys are here to guide you through the complexities of the legal system. As a leading Michigan Family Law Firm, we’ve been assisting clients for years, and our expertise and experience are to your advantage.

- Divorce, including Uncontested Divorce and Military Divorce

- High Asset Divorce

- Child Custody and Visitation Issues

- Child Support

- Mediation for Divorce, Child Custody, and Guardianship

- Alimony and Spousal Support

- Paternity

We’re here to answer all your questions, allay your fears, and provide you with the best options for your individual situation.

Contact us Today For A Complimentary Phone Case Evaluation

Call us 24/7 at (248) 590 6600 Call/Text or Click here to schedule your complimentary consultation.

We Are Here To Help!

Common Questions About Getting a Divorce in Michigan

Common Questions About Child Custody Issues in Michigan